If you hold cryptocurrencies secured by anything other than proof of work, then you should know that there are grave issues regarding the security of funds which you won’t be able to read about in their white papers.

If you hold funds in something which doesn’t have a finite supply and clearly declared issuance policy, then you should be aware of the risks involved with holding such a position.

If you are using a blockchain which does not have on-chain programmability, then you are probably already aware that there is something missing from your platform.

I have specialized for many years in the development of distributed software systems.

I will show you why Proof-of-Stake is going to fail.

In 2018, through a mutual connection, I began working for a cryptocurrency organization which showed great potential and which had created a thriving community with a technical platform with many strong qualities.

Through a series of technical decisions made at the expense of sound economic policies, I bore witness to a foreseeable and avoidable set of human actions which destroyed an immense quantity of wealth. These actions created a schism between a community and its stakeholders, and resulted in a wholesale disenfranchisement.

We saw that a blockchain which used Proof-of-Stake, where insiders control the block production, exert control over the data on the block chain.

There were two parties, one which validated transactions on the chain (strong authoritative power), whom we shall call Alice, and one party which held a significant volume of the token (strong economic presence). We shall call them Bob.

Alice would decide which transactions could be committed, and in what order, to the chain. And they tolerated Bob, who was an active benefactor to the community.

I choose the word tolerated quite specifically. Alice threatened Bob’s transactions on the chain, because she felt threatened by Bob’s ability to modify the code, and Alice would regularly threaten to alter the contents of the chain to essentially delete Bob from the network.

One day, Bob transferred their economic power to someone else (We shall call them Carlos).

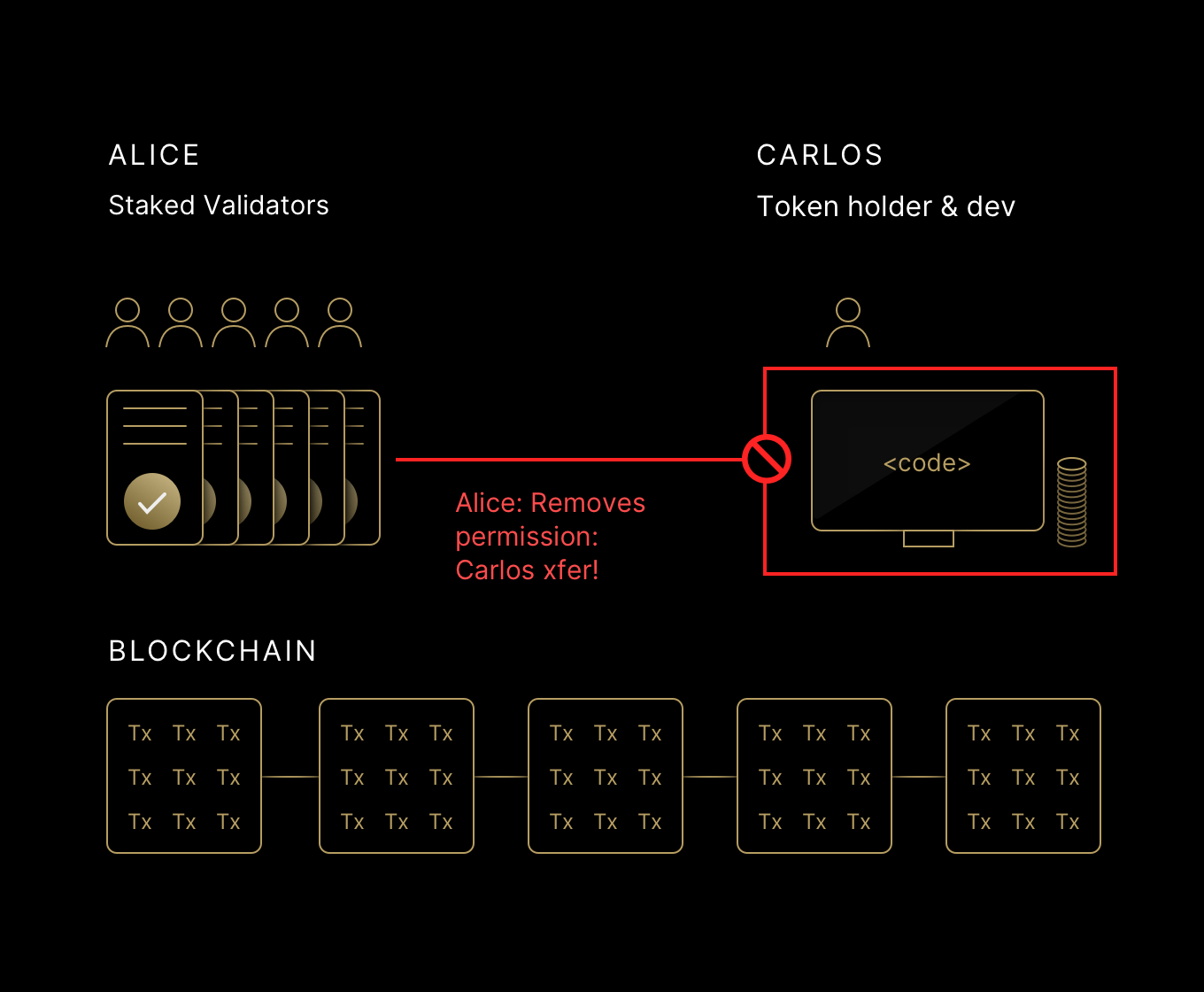

Alice and Carlos did not get along immediately, and Alice threatened Carlos. Alice soon (days) changed the rules on the block chain. First Carlos was not allowed to make transactions.

Carlos reacted, and established block production nodes. They staked their position on the chain, and began altering the rules as well. Carlos used their economic power to establish block production rules which not only allowed them to make transfers, but also began to wipe out Alice’s transactions on the chain.

Alice reacted by forking the entire network and deleted Bob and Carlos on the way.

To my horror, these events were cheered on by community leaders in other chains as “a good thing”.

Alice basically told the entire PoS community: “We will not respect your transactions, or the tokens associated with them. Moreover, your wealth is enough reason for you to be unwelcome”. And when that approach was punished by economic authority, Alice left, and both Alice and Carlos scorched earth out of spite.

Hundreds of thousands of innocents were harmed under the guise of protecting people from the harms of witchcraft - Kean Collection

And the underlying declaration, demonstrated by their actions, was that no investment of time, energy or support would be truly safe on a proof of stake validated network.

Why should I care?

Ethereum is adopting PoS, and opening up every user of every smart contract, every user of every ERC-20, and every ETH stakeholder, to risks implicit in any overly centralized system cryptocurrency. Well formed cryptocurrencies specifically provide trustable mechanics in trustless systems. A lack of equality, access, scarcity, or decentralization, leads to insiders, cartels, and collusion, and associated malfeasance.

The cyclic and predictable aspects of human behaviour mean that when a group of insiders controls (a) too many nodes or (b) too much economic power, that we will see great conflict which will destroy wealth on these networks. Bitcoin was created to rail against this core concept, to provide strong guarantees on trustless networks.

What is pressing is the current adoption of many of these technical decisions being made with little attention, or perhaps comprehension of, the consequences in the medium and long term.

The fundamentals of cryptocurrency are reasonably well established. They are supported by four central pillars:

Decentralization

Supply

Trust

Openness

When we see any market in which supply is controlled by a group of insiders, then we know that such a system is not built for the purposes of providing a service, or utility, but for providing enrichment to the insiders. There are very few organizations which have been able to overcome the innately human nature of self-enrichment.

Any system which is not sufficiently open, which demands too high a barrier to entry, or which does not have clear rules governing the creation, mining, and ownership of monetary supply, is subject to enrichment of the creators.

Strong products, communities, wealth and opportunities are made from strong principles, best practices, and clear vision. Compromising these for technical idealism ultimately destroys value, wealth and trust in the long term.

The current trend to create cryptocurrencies which favour insiders and centralization will lead to failing coins and tokens. We must stay focused on our core purposes; of creating digital-first stores of value, of fast and fair transactions, of security and of accessibility to all. Vigilance is required to ensure that we do not build systems which overly centralize power, either in governance or in reward. Over centralization is harmful for the constituents and users of technologies, and this will be borne out over and over again in the coming years.

If the cryptocurrency you’re holding is governed by Proof of Stake, it’s not a cryptocurrency, it’s a cancer. Proof of stake now comes with a health warning.

If you’re interested in answers to the other questions posed in this article, stay tuned for more

You're an apologist for thieves and conmen. Try not to infect others with your ignorance, greed, or whatever flaw you possess that makes you think theft is ok.

> Alice reacted by forking the entire network and deleted Bob and Carlos on the way.

Anyone can fork a network at any time and in whatever state they see fit. This is called freedom of association.

Alice may have acted poorly by censoring Bob's transactions. But this doesn't excuse Carlos' collusion and deception with exchanges in response.

Also, Carlos failed to secure its credentials allowing (an aspect of) Alice to send large amounts of funds to a some-what trusted exchange, where they sit to this day. What kind of idiot would fail to secure his credentials and expose himself to that kind of attack so easily?